All Categories

Featured

Table of Contents

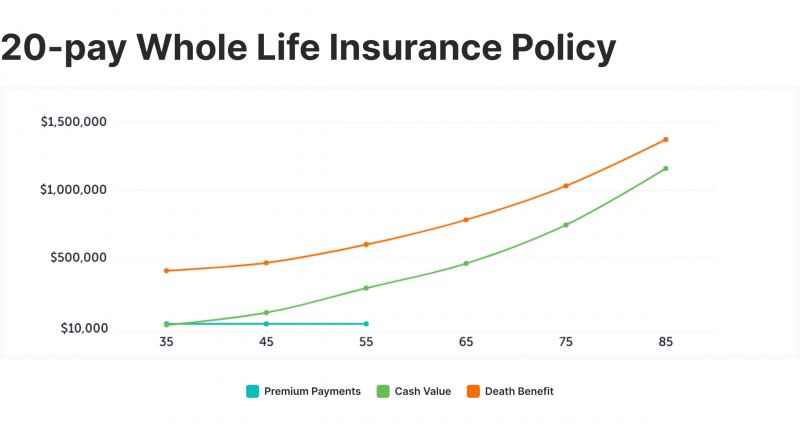

The are entire life insurance policy and global life insurance policy. The cash worth is not included to the death benefit.

After 10 years, the cash value has actually grown to roughly $150,000. He secures a tax-free lending of $50,000 to begin an organization with his brother. The plan financing rate of interest rate is 6%. He pays back the funding over the following 5 years. Going this route, the passion he pays returns right into his policy's cash worth rather than a monetary establishment.

Picture never ever having to stress regarding bank car loans or high rate of interest rates once again. That's the power of unlimited financial life insurance policy.

There's no set financing term, and you have the flexibility to choose the repayment timetable, which can be as leisurely as paying back the lending at the time of death. This flexibility includes the maintenance of the car loans, where you can opt for interest-only settlements, maintaining the loan equilibrium level and workable.

Holding money in an IUL taken care of account being attributed passion can typically be better than holding the money on down payment at a bank.: You've constantly desired for opening your own bakery. You can borrow from your IUL plan to cover the initial expenditures of renting out an area, acquiring tools, and employing personnel.

Bioshock Infinite Vox Cipher Bank

Personal lendings can be gotten from typical banks and credit report unions. Obtaining cash on a credit card is generally really pricey with annual percent prices of passion (APR) typically reaching 20% to 30% or more a year.

The tax treatment of policy loans can differ significantly depending on your nation of house and the specific regards to your IUL plan. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, plan finances are generally tax-free, providing a significant benefit. Nevertheless, in various other jurisdictions, there might be tax ramifications to consider, such as possible tax obligations on the funding.

Term life insurance only gives a survivor benefit, without any type of cash money worth accumulation. This indicates there's no money worth to obtain versus. This post is authored by Carlton Crabbe, Chief Exec Policeman of Funding permanently, an expert in providing indexed global life insurance policy accounts. The details supplied in this post is for academic and informative functions only and should not be interpreted as financial or financial investment advice.

Banking With Life

When you first find out about the Infinite Financial Idea (IBC), your initial response may be: This sounds as well excellent to be real. Probably you're cynical and assume Infinite Banking is a rip-off or system - life insurance infinite banking. We want to establish the record directly! The trouble with the Infinite Banking Principle is not the idea however those individuals offering an adverse review of Infinite Banking as an idea.

As IBC Authorized Practitioners through the Nelson Nash Institute, we assumed we would certainly respond to some of the top concerns individuals search for online when learning and comprehending every little thing to do with the Infinite Banking Idea. So, what is Infinite Financial? Infinite Financial was developed by Nelson Nash in 2000 and fully explained with the publication of his publication Becoming Your Own Lender: Open the Infinite Banking Concept.

How To Start Infinite Banking

You assume you are coming out financially ahead because you pay no rate of interest, yet you are not. With conserving and paying cash, you might not pay rate of interest, however you are utilizing your cash as soon as; when you invest it, it's gone forever, and you offer up on the opportunity to gain lifetime substance rate of interest on that money.

Even financial institutions use whole life insurance policy for the same functions. The Canada Earnings Company (CRA) also recognizes the worth of participating whole life insurance policy as an one-of-a-kind asset class used to generate long-lasting equity safely and predictably and offer tax benefits outside the extent of traditional financial investments.

Standard Chartered Priority Banking Visa Infinite

It allows you to generate wide range by satisfying the financial function in your very own life and the capability to self-finance significant way of life acquisitions and expenses without interrupting the compound passion. One of the easiest methods to consider an IBC-type participating whole life insurance policy plan is it is similar to paying a mortgage on a home.

When you obtain from your participating whole life insurance coverage plan, the cash money worth continues to expand undisturbed as if you never ever obtained from it in the initial location. This is because you are utilizing the money worth and death advantage as collateral for a car loan from the life insurance firm or as security from a third-party loan provider (recognized as collateral loaning).

That's why it's vital to function with a Licensed Life Insurance policy Broker authorized in Infinite Financial that structures your getting involved whole life insurance policy policy correctly so you can avoid adverse tax obligation implications. Infinite Financial as a financial technique is except every person. Right here are a few of the advantages and disadvantages of Infinite Banking you should seriously consider in making a decision whether to move on.

Our recommended insurance coverage provider, Equitable Life of Canada, a shared life insurance policy firm, focuses on taking part whole life insurance policy plans details to Infinite Banking. Likewise, in a common life insurance coverage business, policyholders are taken into consideration company co-owners and obtain a share of the divisible excess produced yearly through dividends. We have an array of carriers to pick from, such as Canada Life, Manulife and Sun Lifedepending on the needs of our clients.

Please additionally download our 5 Leading Questions to Ask A Boundless Financial Representative Before You Work with Them. To find out more regarding Infinite Financial visit: Please note: The product provided in this e-newsletter is for informative and/or educational purposes only. The info, viewpoints and/or views expressed in this e-newsletter are those of the writers and not necessarily those of the representative.

Private Family Banking Life Insurance

The idea of Infinite Financial was developed by Nelson Nash in the 1980s. Nash was a financing professional and follower of the Austrian institution of business economics, which promotes that the worth of items aren't explicitly the result of standard financial frameworks like supply and demand. Instead, individuals value cash and products in different ways based on their financial standing and demands.

Among the pitfalls of typical financial, according to Nash, was high-interest prices on fundings. Also several individuals, himself consisted of, got involved in monetary problem because of reliance on financial institutions. So long as banks established the interest prices and loan terms, individuals really did not have control over their very own riches. Becoming your very own banker, Nash established, would put you in control over your economic future.

Infinite Financial needs you to have your financial future. For goal-oriented people, it can be the most effective monetary device ever before. Right here are the benefits of Infinite Banking: Arguably the single most useful facet of Infinite Financial is that it boosts your capital. You do not require to experience the hoops of a standard bank to obtain a loan; just request a policy funding from your life insurance company and funds will certainly be provided to you.

Dividend-paying entire life insurance policy is really low danger and provides you, the policyholder, an excellent offer of control. The control that Infinite Financial offers can best be organized into two classifications: tax benefits and possession defenses.

Entire life insurance coverage plans are non-correlated assets. This is why they function so well as the financial structure of Infinite Financial. Regardless of what occurs in the market (stock, actual estate, or otherwise), your insurance plan maintains its worth.

Whole life insurance policy is that 3rd pail. Not only is the rate of return on your whole life insurance plan guaranteed, your death advantage and costs are likewise guaranteed.

The Infinite Banking Concept

Infinite Banking allures to those seeking higher economic control. Tax obligation effectiveness: The cash money worth expands tax-deferred, and plan financings are tax-free, making it a tax-efficient tool for building riches.

Property defense: In numerous states, the money worth of life insurance policy is safeguarded from creditors, adding an additional layer of economic security. While Infinite Banking has its advantages, it isn't a one-size-fits-all service, and it features significant downsides. Below's why it may not be the most effective technique: Infinite Financial usually requires intricate policy structuring, which can puzzle insurance holders.

Latest Posts

Infinitebanking Org

How To Start Your Own Offshore Bank

Learn How To Become Your Own Bank!